In today’s connected world, sending money across borders is no longer a luxury—it’s a necessity. Whether you're transferring money from UAE to UK, looking to transfer money to India, or even making a money transfer to Bangladesh, picking the right provider can be overwhelming. From hidden fees to slow delivery and unresponsive customer support, the wrong choice can cost you more than just money.

But don’t worry. This guide is built to help you cut through the clutter. By the end, you’ll know exactly how to choose a reliable money transfer service provider that is fast, secure, and trustworthy.

It’s not just about sending money—it’s about safety, speed, cost, and convenience. Here's what’s at stake:

A good provider eliminates these issues while giving you peace of mind.

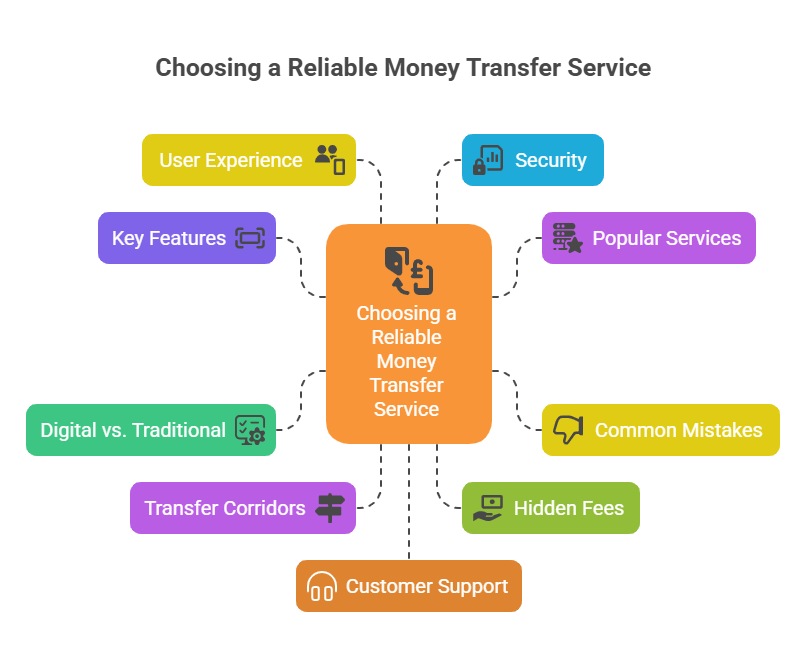

When choosing the best money transfer service, keep these criteria in mind:

First, always ensure the provider is approved and licensed in the country of operation. This proves they follow laws and protect your data and money. You can search “money transfer services near me” and verify if they’re authorized.

Avoid vague fee structures. Choose services that show:

This makes it easier to compare with other international money transfer services.

Some services offer instant transfers, while others take 2-5 days. Make sure you know what to expect—especially if it’s an urgent remittance.

From bank deposits and mobile wallets to cash pickup, a reliable provider offers multiple ways to receive funds.

Whether you're making a money transfer to Bangladesh, or want to transfer money from India to UK, the provider should support your corridor and offer favorable exchange rates.

Flexible funding options—like debit/credit card, bank transfer, UPI, or digital wallets—give you ease and convenience.

Here are some known names in the industry:

| Service | Best For | Transfer Speed | Key Feature |

|---|---|---|---|

| Wise | Transparent Pricing | 0-2 Days | Real-time mid-market rates |

| Western Union | Transparent Pricing | 0-2 Days | Real-time mid-market rates |

| Remitly | Transparent Pricing | 0-2 Days | Real-time mid-market rates |

| Small World Money Transfer | Transparent Pricing | 0-2 Days | Real-time mid-market rates |

Always compare options based on your specific corridor (e.g. transferring money from UAE to UK or money transfer to India).

Even if you've found an approved service for money transfer, watch out for these traps:

Do your due diligence.

Let’s break it down by popular routes:

Look for low transfer fees and INR-friendly exchange rates. UPI is a great option here.

Ensure the provider is RBI-approved and FCA-regulated in the UK.

Bangladesh-bound remittances may benefit from services with local partner banks.

Look for options that support AED and GBP efficiently with fast delivery windows.

The advertised fee is only part of the story. A common trick is to offer zero fees but mark up the exchange rate. This means:

Use comparison tools or the provider’s fee calculator before finalizing the transfer.

We live in an app-driven world. A great mobile experience includes:

This is especially helpful for users making frequent transfers or managing family expenses abroad.

Make sure the service:

Your personal and financial data should never be at risk.

Good support can save the day when things go wrong. Check:

Read online reviews for feedback on real experiences.

Choosing the right international money transfer service in 2026 comes down to transparency, reliability, speed, and customer focus. With many options out there, your decision impacts not just your wallet—but also your peace of mind.

At RemitSo, we empower global remittance providers with secure, scalable, and fully customizable software platforms. From compliance automation to one-touch integrations and robust reporting, we provide everything a modern remittance business needs to operate efficiently.

Whether you’re a consumer looking to transfer money to India, or a business seeking scalable money transfer services, we’ve got you covered.

The most reliable services offer secure transfers, transparent fees, fast delivery, and strong customer support. Always choose a provider that is licensed, well-reviewed, and fits your transfer needs and destination.

Search "money transfer services near me" on Google or check with your local financial authority for licensed providers.

Yes. Some providers mark up exchange rates or add processing fees. Always check the total cost before confirming.

It can take from a few minutes to 2 business days depending on the service used and payment method.

Digital services usually offer better rates than banks. Compare transfer fees and exchange rates before choosing.