AML compliance is an essential component of modern financial operations, helping businesses prevent money laundering, fraud, and financial crimes. A well-structured AML compliance program ensures adherence to regulatory requirements while safeguarding an organisation's reputation.

In this article, we’ll explore 6 critical steps to building a robust AML compliance framework, covering key aspects such as risk and compliance, KYC compliance, and an AML compliance checklist.

An effective AML compliance program begins with a thorough risk assessment to identify vulnerabilities in an organisation’s financial activities.

By understanding risks, businesses can implement effective compliance controls to mitigate financial crimes.

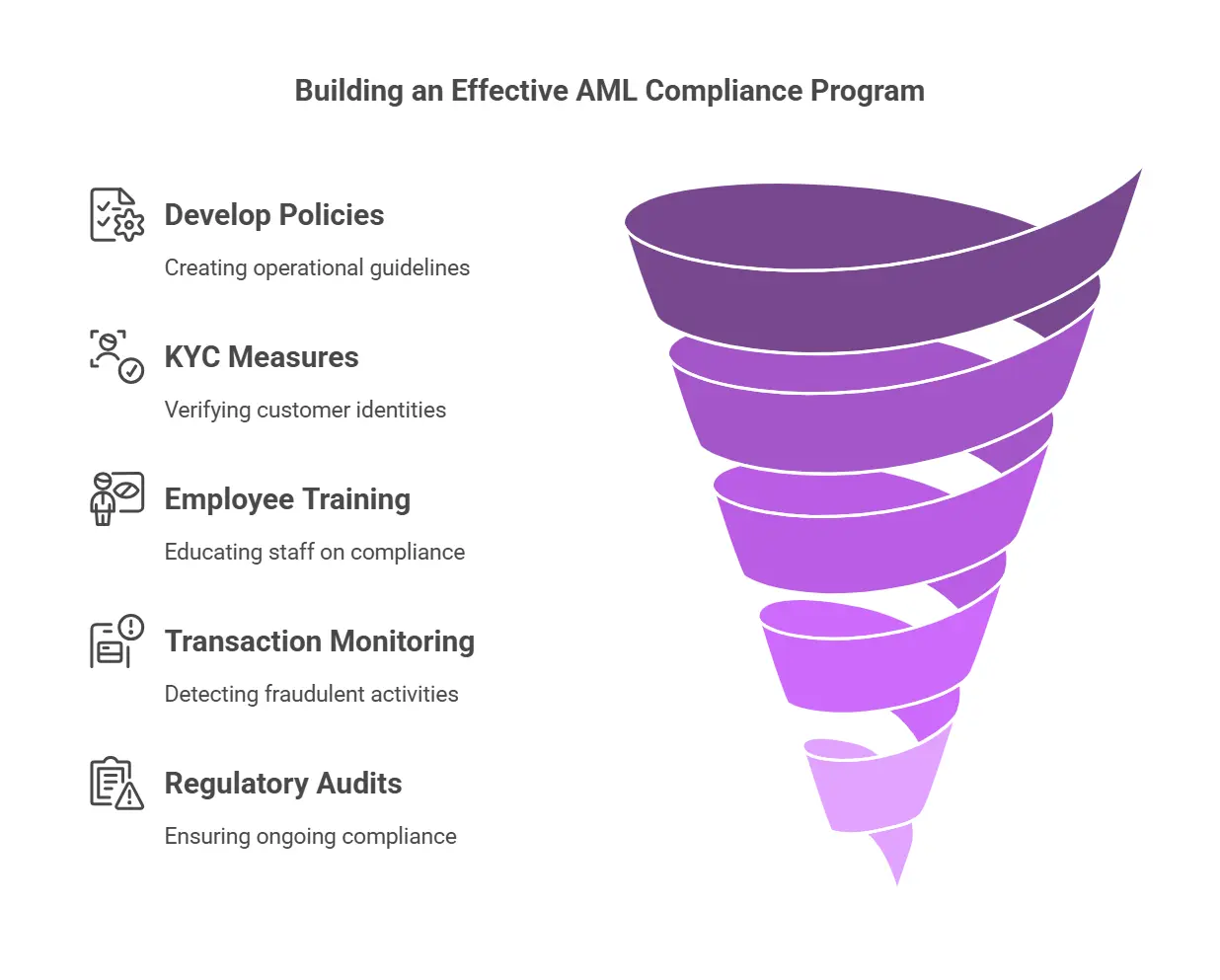

A well-documented AML compliance checklist ensures clear operational guidelines. Organisations must develop policies that align with global standards, such as those set by the Financial Action Task Force (FATF) and local regulatory bodies.

KYC compliance is the foundation of a strong AML compliance program. It involves verifying customer identities to prevent fraud and money laundering.

A weak KYC process exposes businesses to financial crimes, increasing regulatory penalties.

A compliance AML program is only effective if employees understand their responsibilities. Companies must conduct regular AML training to educate staff about identifying suspicious activities and adhering to compliance matters.

A well-trained workforce strengthens AML compliance, reducing the risk of regulatory breaches.

A strong AML compliance checklist includes real-time transaction monitoring to detect fraudulent activities.

Transaction monitoring is a critical element of AML compliance that prevents financial crimes before they escalate.

A successful AML compliance program requires continuous monitoring and audits to stay aligned with regulations.

Regular audits prevent non-compliance issues and protect organisations from regulatory fines.

Building an effective AML compliance program requires a structured risk-based approach, strong KYC policies, and ongoing monitoring. By following the 6 steps outlined above, businesses can ensure regulatory adherence while minimising financial risks.

Need expert AML compliance solutions? We at RemitSo specialise in risk and compliance consulting, providing tailored AML solutions to safeguard businesses against financial crimes.

Stay compliant, stay protected! Contact RemitSo today for professional AML guidance.

AML compliance refers to the processes and regulations that businesses follow to prevent money laundering, fraud, and financial crimes. It includes KYC compliance, transaction monitoring, and regulatory reporting.

An AML compliance checklist helps businesses maintain adherence to financial regulations by ensuring they meet key requirements, such as customer due diligence, suspicious activity monitoring, and regulatory audits.

A junior compliance officer assists in monitoring transactions, reviewing customer profiles, and ensuring AML policies are followed within an organisation.

KYC compliance ensures that businesses verify customer identities and assess financial risks, preventing money laundering and fraudulent activities.

AML compliance programs should be reviewed annually or whenever regulatory updates occur, ensuring they remain effective in preventing financial crimes.

A compliance analyst is responsible for analysing transactions, detecting suspicious activities, and ensuring adherence to AML regulations.