The rise of neobanks is reshaping the global financial landscape. Unlike traditional banks, neobanks operate entirely online, offering streamlined, low-cost banking services tailored to modern consumers. With growing demand for digital banking solutions, launching a neobank in 2026 presents a lucrative opportunity.

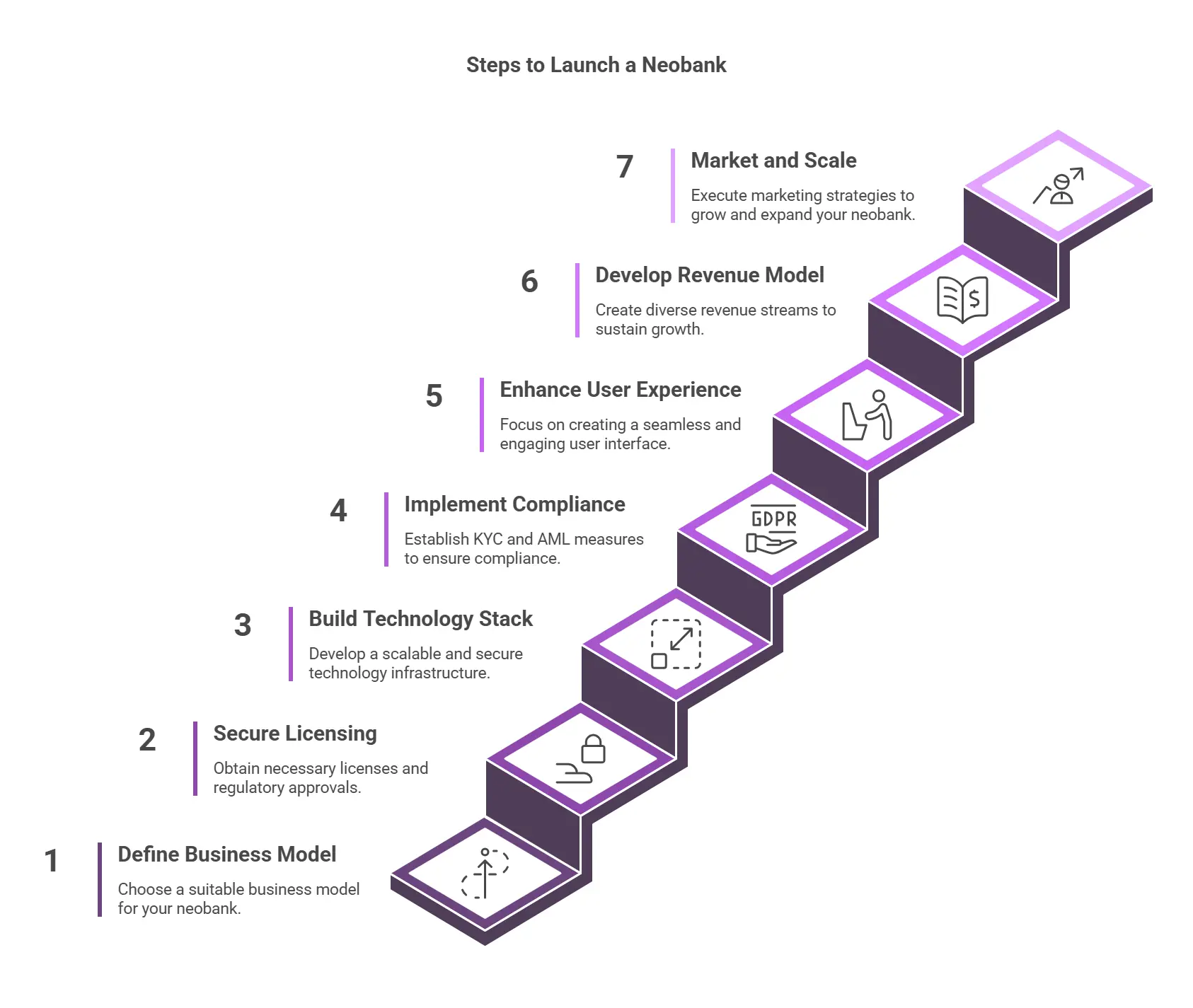

However, starting a neobank requires regulatory approvals, a strong technology stack, and a clear business model. Whether you’re an entrepreneur, a fintech enthusiast, or a financial institution looking to enter the challenger banks market, this guide will walk you through everything you need to know.

A neobank is a digital-first financial institution that provides banking services without physical branches. Unlike traditional banks, neobanks leverage fintech innovations to offer seamless customer experiences, often focusing on mobile banking, AI-driven financial tools, and automation.

Some well-known neobanks in the US include Chime, Varo, and Current, while in the UK, the top challenger banks include Monzo, Revolut, and Starling Bank.

The global fintech industry is projected to grow exponentially, with neobanks leading the charge. Here's why 2026 is a golden opportunity:

If you want to disrupt traditional banking, now is the time to start your neobank.

Before launching, decide on the business model:

Each model has different regulatory and operational challenges, so choose wisely based on your funding and target audience.

Regulatory approval is one of the biggest hurdles in launching a neobank. Depending on your country, you may need:

Each model has different regulatory and operational challenges, so choose wisely based on your funding and target audience.

Research the regulatory landscape before proceeding to avoid compliance issues.

A neobank’s success depends on its technology infrastructure. Here’s what you need:

To prevent fraud and money laundering, every neobank must follow strict KYC (Know Your Customer) and AML (Anti-Money Laundering) guidelines.

Best Practices for Compliance:

Regulatory compliance is not optional—it’s the foundation of a trusted fintech business.

Neobanks win customers by offering seamless, mobile-first banking experiences. Key focus areas:

User experience is everything in neobanking—invest in top-tier UI/UX design.

Unlike traditional banks, neobanks have unique revenue streams:

Diversify revenue sources to build a scalable fintech business.

Your neobank needs a strong marketing strategy to attract users.

Best Marketing Strategies for Neobanks:

Once you gain traction, consider expanding to new markets for long-term growth.

Launching a neobank in 2026 is a complex but rewarding journey. From securing licensing to building a scalable tech stack, success requires strategic planning and the right partners.

We at RemitSo provide a cutting-edge platform to help fintech companies and neobanks scale efficiently. Our API-driven solutions ensure compliance, automation, and seamless cross-border transactions—so you can focus on growing your business.

Want to accelerate your neobank’s launch? Contact RemitSo today!

Starting a neobank can cost anywhere from $2 million to $10 million, depending on licensing, technology, and marketing.

Neobanks operate fully online, while challenger banks may have physical branches but use digital-first strategies.

Not always. Some neobanks partner with BaaS providers to operate without direct licensing.

Popular neobanks in the US include Chime, Varo, and Current.

They generate revenue through subscriptions, interchange fees, lending, and FX transactions.