In the global remittance and money transfer ecosystem, regulatory expectations have never been higher. Money Transfer Operators (MTOs) operate in a high-risk environment involving cross-border payments, customer onboarding, transaction monitoring, sanctions exposure, fraud threats, and operational vulnerabilities.

To manage these risks effectively, the financial industry—and increasingly regulators—expect companies to adopt the Three Lines of Defense (3LOD) model.

This structured governance model ensures that AML (Anti-Money Laundering), CTF (Counter-Terrorist Financing), and fraud mitigation efforts are distributed across distinct layers of responsibility. Each layer plays a critical role in protecting an organization from financial crime, regulatory penalties, reputational harm, and operational failures.

This complete guide explains the Three Lines of Defense through the lens of MTOs, digital remittance companies, fintechs, and cross-border payment providers, aligning with global regulatory guidance from FATF, FinCEN, FCA, AUSTRAC, MAS, and others.

The Three Lines of Defense (3LOD) is a globally recognized governance and risk management framework. It divides risk ownership, oversight, and audit responsibilities into three structured layers:

First Line of Defense – Business Operations & Frontline Teams

Responsible for owning risks and implementing day-to-day controls.

Second Line of Defense – Risk & Compliance Functions

Oversees, guides, and strengthens the first line’s activities.

Third Line of Defense – Internal & External Audit

Conducts independent assessments to verify the effectiveness of the entire risk framework.

For MTOs, this model is essential because regulatory bodies expect remittance businesses to demonstrate clear accountability, strong AML controls, and independent auditing.

The First Line of Defense consists of the individuals and teams directly involved in customer-facing operations, onboarding flows, processing transactions, and managing daily financial activities.

For MTOs and remittance companies, these functions include:

In short, the first line owns operational risk and is responsible for carrying out AML and fraud controls in real time.

Money transfer companies face unique challenges:

Frontline teams and operational systems are your first filter against money laundering.

The First Line should have clearly documented SOPs, immediate access to tools (screening, monitoring, risk scoring), and continuous training.

The Second Line consists of the teams responsible for designing, enforcing, and optimizing an organization’s risk and compliance framework.

These include:

While the First Line implements controls, the Second Line ensures those controls are strong, updated, and effective.

The Second Line must remain independent from business operations, ensuring that revenue pressures do not compromise compliance integrity.

Regulators expect MTOs to:

A weak Second Line is one of the top reasons regulators fine remittance companies worldwide.

The Third Line consists of internal auditors, external auditors, or independent consulting firms that evaluate the entire compliance framework.

Unlike the First and Second Lines, the Third Line must be fully independent.

For MTOs, the Third Line must confirm that:

The Third Line is often the difference between a clean audit or enforcement action.

While all three lines contribute, the Second Line carries ownership of AML risk.

It is the role of compliance and risk teams to:

However:

For MTOs, regulators expect these responsibilities to be clearly documented and traceable.

Below is a simplified mapping of the 3LOD model specifically for MTOs.

This layered model is essential for establishing a safe, compliant, and regulator-approved MTO operation.

Remittance companies operate at the intersection of:

According to the FATF 2024 Guidance for Money Value Transfer Services (MVTS), MTOs must implement a multi-layered governance structure. The Three Lines of Defense ensures:

Failure to implement this model can lead to:

Policies, procedures, SOPs, and risk matrices must be written, approved, and updated regularly.

Manual controls are error-prone. MTOs should automate:

Frontline staff and operational teams must understand:

Even if not mandated, annual audits protect the business and satisfy regulators.

Each identified risk should have a mapped control, owner, and frequency.

They are a governance model with three layers:

First Line: Operations

Second Line: Compliance & Risk

Third Line: Internal/External Audit

The Second Line (Compliance) owns AML risk, while the First Line executes controls and the Third Line audits the system.

Because regulators like FATF, FinCEN, FCA, and AUSTRAC expect MTOs to demonstrate clear accountability and layered AML protection.

It performs customer onboarding, KYC checks, transactions, and real-time fraud detection.

To independently evaluate how well AML and fraud controls are functioning and report findings to senior leadership.

Ideally annually, or more frequently if operating in high-risk markets.

Automated KYC platforms, transaction monitoring systems, sanctions screening tools, case management systems, and audit documentation tools.

No—technology enhances controls, but human governance, oversight, and auditing remain essential.

The Three Lines of Defense framework is no longer optional for Money Transfer Operators—it is a regulatory expectation. With rising fraud threats, global sanctions risks, and evolving AML requirements, MTOs must build a structured, multi-layered compliance infrastructure to remain safe, trustworthy, and fully compliant.

A strong 3LOD model ensures:

If you’re building or scaling a money transfer business, RemitSo can help you strengthen every layer of your governance model.

RemitSo provides:

If you need a complete remittance platform with built-in compliance—or expert AML advisory—RemitSo is your trusted partner.

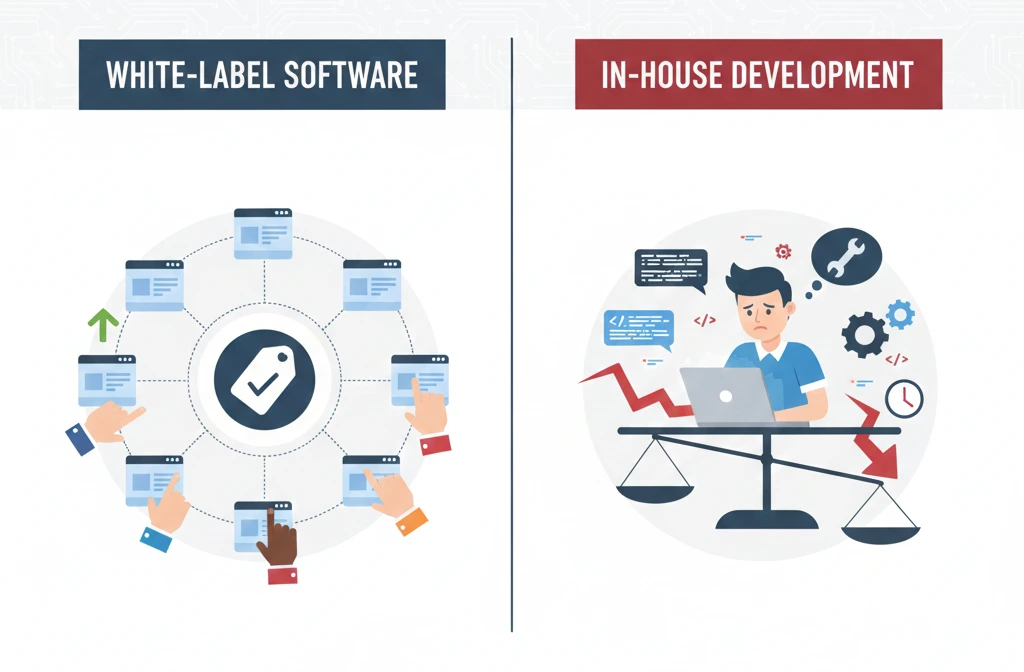

If you're evaluating white-label vs in-house remittance technology, platforms like RemitSo can help you launch quickly with compliant, scalable infrastructure—without the cost and complexity of a full engineering build.

Need Help Launching Your Remittance Business?