Running a money transfer business today isn’t just about sending funds from Point A to Point B. Whether you’re operating in the US, UK, Europe, Australia, Canada, or Africa, financial regulations are getting tighter, and compliance is more critical than ever. From protecting your business reputation to avoiding hefty fines or license suspensions, staying on top of compliance requirements is a non-negotiable part of doing business.

Yet, many remittance companies especially small to medium-sized money service businesses (MSBs) make avoidable compliance mistakes. These slip-ups can cost time, money, and hard-earned customer trust.

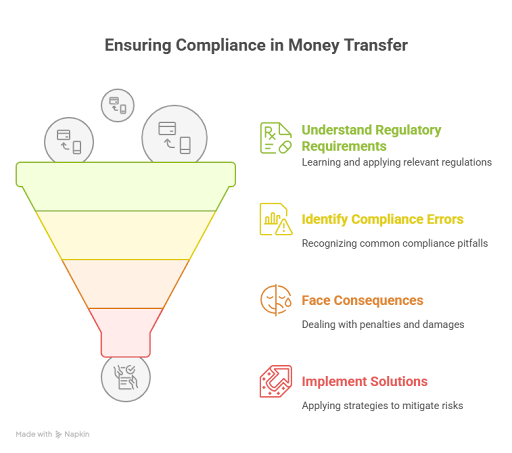

Let’s look at the five most common compliance issues in the industry and how to fix them before they become a real problem.

One of the biggest mistakes money transfer businesses make is treating their Anti-Money Laundering (AML) and Counter-Terrorism Financing (CFT) program like a checkbox exercise. That approach almost always leads to gaps regulators will spot.

Signs you might be at risk:

Why it matters: These programs are your first line of defense against financial crime. If your AML setup is weak, it’s not just about breaking the rules, it’s about unknowingly becoming a vehicle for money laundering or worse.

Fix it: Build a real AML/CFT program. Tailor it to your business risks, review it at least once a year, and make sure everyone on your team knows their role.

In some countries, onboarding new customers without properly verifying their identity can land you in serious trouble. KYC (Know Your Customer) isn't just a buzzword. It's a global requirement and a foundation of financial compliance.

Here’s where many businesses go wrong:

Why it’s risky: In places like the UK or the US, failing KYC checks can lead to audits, fines, or even being blacklisted by banks.

Fix it: Use reliable KYC resources - digital verification, biometrics, document validation and always follow your country’s KYC rules.

Every money transfer business needs to watch for suspicious transactions. Unfortunately, this is where many fall behind. Whether it’s due to old systems or limited staff, transactions that should raise red flags often go unnoticed.

What gets missed:

Why it’s dangerous: It leaves your business exposed to AML/CFT violations, FATF non-compliance, and hefty penalties from regulators.

Fix it: Automate transaction monitoring. Use software that flags unusual behavior, logs decisions, and helps you file Suspicious Activity Reports (SARs) when needed.

Every remittance business faces different risks based on its services, customers, and countries served. But many don’t regularly revisit those risks—or document them properly.

Common gaps:

What this causes: It leads to blind spots in your compliance program. Regulators won’t care if you say you “didn’t know.”

Fix it: Update your risk assessments at least once a year—or sooner if your services or markets change.

Sanctions screening means checking customers and transactions against government watchlists (like OFAC in the US or the UN list globally). Many small MSBs miss or only partially perform this step.

How it happens:

The result: This isn’t just a fine - it could mean freezing accounts, facing lawsuits, or losing your license.

Fix it: Use an automated tool to screen every transaction and party - every time. And keep audit records of all screenings.

| Compliance Area | Risk if Ignored | Recommended Action |

|---|---|---|

| AML/CFT | Regulatory penalties, shutdowns | Build a tailored AML program |

| KYC/Onboarding | Fraud, loss of banking relationships | Use digital KYC tools, train staff |

| Transaction Monitoring | Missed red flags, delayed reporting | Automate alerts, escalate suspicious activity |

| Risk Assessments | Compliance blind spots | Update assessments regularly |

| Sanctions Screening | Legal action, reputational damage | Automate screening, keep records |

Whether you serve customers across Europe, Asia, or North America, one thing is clear: regulators are paying attention. A single overlooked detail whether a missed ID check or an unchecked transaction can put your license and reputation on the line.

We at RemitSo understand the pressure. Our platform is built to help money transfer businesses stay compliant, efficient, and ahead of risk whether it’s KYC, AML, sanctions screening, or audit readiness.

If you’re unsure about your current compliance setup or just want a second look, we’re here to help.

Contact us today to strengthen your compliance and safeguard your operations.

They include poor AML/CFT programs, ineffective KYC practices, inadequate transaction monitoring, and missing or outdated risk assessments.

Examples include onboarding customers without verifying ID, failing to file suspicious activity reports, and sending funds to sanctioned entities.

They can result in regulatory fines, bank account closures, and even criminal charges depending on the severity and intent.

It helps identify unusual or suspicious patterns, protecting your business from being used to launder money or finance crime.

In the US, FinCEN focuses on SAR filing, sanctions checks, and record-keeping. In the UK, the FCA demands strict KYC, AML, and customer transparency.

At least annually, or whenever regulations, products, or markets change significantly.