For Your Business (Back Office)

Manage treasury, compliance, and user operations from a single, bank-grade platform

Stop building from scratch. Get a white-label platform that combines a beautiful user app with a powerful bank-grade back office

Manage treasury, compliance, and user operations from a single, bank-grade platform

You receive our onboarding checklist. After you fill it out, we schedule a kick-off call to finalize all remaining requirements, understand branding, app design (UI/UX), and plan your server setup.

We deploy your staging server, admin panel, and web app. Your system is ready for User Acceptance Testing (UAT).

Web portal is now ready for UAT and can go live for transactions. Simultaneously, we deliver the first testing build of your branded mobile app for your review.

We implement your feedback from UAT and move the tested web and mobile apps to a secure pre-production environment for your final sign-off.

After your final sign-off on pre-production, we deploy your live production server. We then manage the complete app submission and approval process.

Once your apps are approved by the stores, they are live. You are now ready to onboard customers from every channel and scale your business.

"The RemitSo team provided the perfect white-label solution and the partnerships we needed to get started. Their end-to-end support meant we could focus entirely on our customers from day one." Mr. Riaz Uddin, Founder of Veloxpays (Australia)

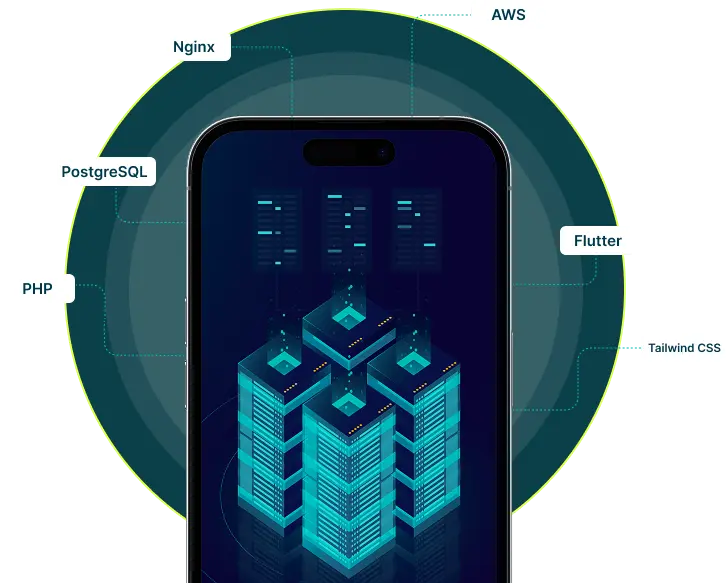

Built on the reliable AWS cloud leveraging, AWS SQS/SNS/SES

AWS Lambda for serverless computing, RDS databases, and S3 for storage

Laravel Vapor for smoother updates, greater stability, efficient user experience

AWS Lambda and asynchronous processing (SQS), to handle high transaction volumes and manage peak times.

Articles, Insights, FAQs and More